What is the Highline School District Levy? Is it a Renewal? Is it an Increase?

The answer: both! The Highline School District’s 2027-30 operations levy on the Nov 4th ballot is both a renewal and an increase. It is a renewal of the previous levy that is expiring, but it is also a major increase.

[Disclosure: Having participated in numerous Highline Pro levy and Pro bond campaigns since 2001, I understand the challenge of presenting accurate financial data. While rates may decrease, total taxes can still rise due to increasing assessed values. This analysis aims to provide a comprehensive tax overview for taxpayers. Please contact the editors with any feedback on potential bias or to correct any errors.]

While this story touches on the broader picture of state school funding changes (a topic covered very little by any news sites), the main goals are first, to inform readers how much more they are going to pay in 2026, and second, the cost to taxpayers of the levy on the Nov 4th ballot.

I have worked with and received many of these numbers and reports from the Highline District and appreciate their time in helping me work through it all. But here are some of my conclusions based on the raw information available to us:

· The local levy tax in 2026 will be 21.6% higher than in 2025.

· The local levy tax by 2030 will be 61% higher than their 2025 amount!

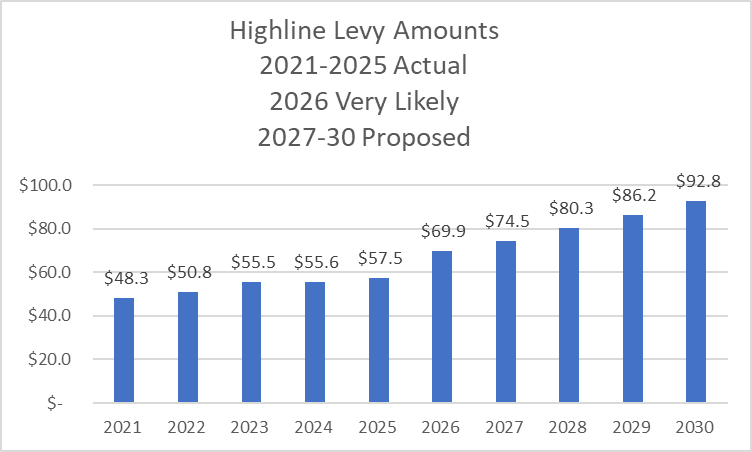

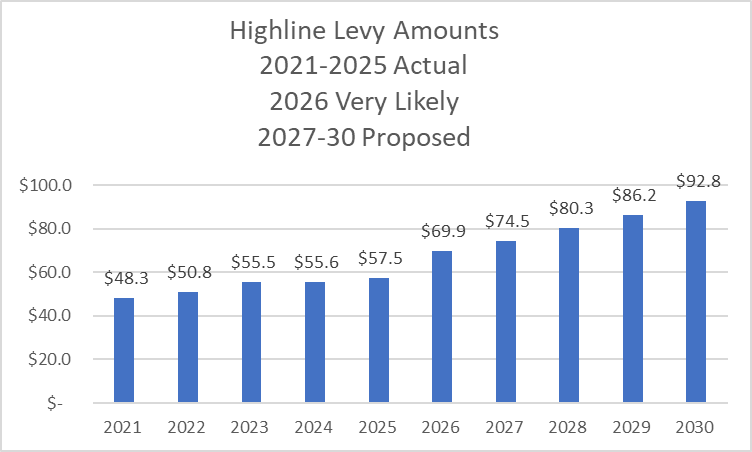

Here’s a bar graph showing the amounts in millions of dollars. Since 2021, Levy funds are set to double by 2030.

"What does that mean for me and my household," you ask?

· A homeowner with an assessed value of $800,000 in 2025 will have paid $1,457 in local school levies. By 2026, they will pay $315 more, or $1,771. But by 2030, they will pay about $2,345, which is $888 more than their 2025 total. (This only accounts for the School Levy portion and does not calculate state property tax calculations that now add population growth and inflation, which is an entirely different story. This also assumes property values change at the same rate as the district average.)

· Renters will be affected as well. For an apartment valued at $200,000, the current tax is $364. The 2026 increase would be $79, for a total of $443. Expect the 2030 tax to be $584, or $222 more per year. Most likely landlords will add $19/month or more to the rent.

Often, levy campaigns will use a “median” value used by the King County Assessor. For Highline in 2025, the median is $583,000. However, a quick search on a major real estate site finds only a third of homes and condos for sale are at or below the supposed median value. I recently checked some values of homes that are nearly on the edge of the buyout zones due to high airport noise and was very surprised to see these houses were assessed at the supposed district median.

This table shows collections, increases, and related numbers.

Year | Levy dollars collected or proposed (1) | Levy dollar Increase from previous year | % Increase from previous year | Levy $ Rate / $1000 of assessed value | Median Home Value ($000) | Operations Levy $ for Median Home (2026-30 are estimates) | Levy per $100,000 of assessed value |

|---|---|---|---|---|---|---|---|

2021 | $688,368 (2) | 0.1% | $944 | $205 | |||

2022 | 2,509,764 | 5.2% | $520 | $1,053 | $203 | ||

2023 | 4,683,411 | 9.2% | $1,051 | $193 | |||

2024 | 55,281 | 0.1% | $516 | $974 | $189 | ||

2025 | 1,885,739 | 3.4% | $583 | $1,062 | $182 | ||

2026 | 12,409,672 | 21.6% | Not yet set | Not yet set | $1,261 | unknown | |

2027 | $74.5 MM | 4,626,513 | 6.6% | Not yet set | Not yet set | $1,344 | unknown |

2028 | 80.3 | 5,800,000 | 7.8% | Not yet set | Not yet set | $1,449 | unknown |

2029 | 86.2 | 5,900,000 | 7.3% | Not yet set | Not yet set | $1,554 | unknown |

2030 | 92.8 | 6,600,000 | 7.7 % | Not yet set | Not yet set | $1,674 | unknown |

(The above bar chart and table illustrate the levy amounts that have been collected for calendar years 2021-2025, plans for 2026, and the amounts proposed for 2027-30 if the Nov 4 levy passes. The proposed amount for 2027 is $74.5 million per year, rising to a proposed $92 million in 2030. This is a four-year total of up to $330 million. The exact amount could be a few million less, depending on enrollment, as stated in the King County elections voter guide. The total for 2022-25 calendar years was $219.4 million, so the $330 request would be a 50.6% increase over that four year period.)

Notes:

1. I am listing the amount expected in 2026. For 2027-30, I am listing the maximum. There is a chance the amount will be a few percent less, depending on enrollment. For example, the 2027 medium scenario is $3MM less, or 4%, to $71MM.

2. 2020 levy amount was $47,641,252. The rate was $2.09532 per thousand.

The Total 2026 Levy Collection Increases 21.6%, from $57.4MM to $69.9MM

The 2025 calendar year Highline levy collection is $57.4 million, according to King County. The 2026 collection will be $69.9 million, according to page 3 the board resolution. The one-year levy increase is $12.4 million, or 21.6% (The next section of the resolution also mentions another collection of $73 million - this is for repaying construction bonds.)

· To put this number in perspective, the levy in 2025 was only $9.8 million more than the levy in 2020. We have a bigger increase in one year than we had in the previous six combined. Comparison to pre 2020 is challenging because of the McCleary changes, where local levies decreased and taxes paid to the state school fund increased.

· Voters do not have any further say on this 2026 increase, it was authorized by voters in November 2021. At the time, the full amount could not be collected, but as a district spokeswoman said at the time “if the state changes the law, we want to be ready.” The state changed, and Highline was ready.

Why the Increase?

It is not because of rising enrollment (enrollment is actually forecast to be within a few percentage points of current levels.) Rather, the state has changed the laws about how much local levy can be collected. After McCleary was fully enacted in 2018, the state specified a maximum of $2500 could be collected per student from local levies, with strict guard rails of where the money could go. In keeping with the court ruling, levy funds could not be used towards basic education, “because the state was fully funding it.” Instead, the levy dollars could only go towards “enrichment.” Well, in the spring 2025 session, the legislature changed the law. The amount a district can collect is increasing each year, with different maximums for different districts. According to the final bill report for HB2049, it appears the maximum per student in Highline will be $5,035 in calendar year 2031.

It is definitely confusing to be writing both about next year’s levy collection and future years. The district chose to run the levy in November 2025 with minimal discussion in board meetings about why now, vs waiting until February, the usual date for running school funding votes. (The only other operations levy on the ballot in the region is in Renton. They are asking for $250MM. Highline with 21% more students is asking for roughly 33% more money than Renton.)

What Would a Levy Failure Mean?

Sometime in the 2026 calendar year, the school board could decide to run another levy request. Possible dates include February or April. New board members may have different perspectives on what should be included in the levy, and what the amount should be. No programs will be cut during the current school year if the levy fails.

Where Do Levy Dollars Go?

As explained by Highline district staff in an interview two weeks ago, the levy money is about 15% of total district funding. Much of it is mingled with other funds. Highline staff stated in a follow up email:

“Please refer to the presentation from the June 2025 Board Work Session on the 2025-26 budget. Slide 17 provides a breakdown of the proposed spending of our levy funds for the 2025-26 school year. Additionally, you can access the presentations from the June 2024 and June 2023 Board Work Sessions, which also include a slide about how levy funds have been allocated. If you need information from earlier years, please visit this webpage, where you can select the respective year to find links to the board work session presentations for those years.

At the close of every fiscal year, all Washington school districts report their financials (actuals) to OSPI. This report is called the F196. Included in every district’s F196 are two pages that break down the district’s financials by local/levy (Sub-Fund 11) and non-levy (Sub-Fund 10.) Every district’s F196 is available for download on OSPI’s reporting webpage. Open any “F-196 All Pages” PDF and do a ctrl+F search for the term “sub-fund” and you’ll find those two pages, which shows a summary of revenues and expenditures for the year by major source and program. This provides a high-level overview of the use of levy funds.”

A few specific non salary items mentioned in the interview and then in follow up email included insurance, up from $3.31 million in 2021 to an estimated $6.7 million for 2025-26, and electricity, gas, water, sewage, garbage, recycling, surface water management, from $2.1 million to $4.2 million in the same years.

Special ed funding has changed. The state gave a slight increase for special ed funding, This is complicated. Here are comments from two sources: local, and Olympia.

In the interview the Highline district staff stated that the amount of special ed funding they get is $19 million less than the cost of providing special ed services. (This story does not have space to cover how that figure is calculated, or the financial impacts of Highline’s approach of having inclusive classrooms with most special ed students in regular classrooms.)

Shawn Lewis, who works in finance for the Office of the Superintendent of Public Instruction, stated about special ed funding:

In one section of the recently passed bill, the Legislature changed the accounting requirements for school districts. This section requires a district to use state basic education resources to supplement direct special education funding before relying on local levy funding for these services. This has the result of directing more state funding to support special education costs – with an equal amount of local levy revenue being shifted away from special education to support basic education. This section of the bill is strictly a change in accounting practice and does not provide additional resources to a school district – it simply changes the source of resources being used to fund special education costs. In other sections of the same bill and in the 2025-27 budget, the Legislature provided new special education funding (for the special education multiplier and increasing state safety net funding) The additional funding along with the accounting change will likely result in most districts showing significantly less local levy funding support for special education costs.

For Additional Perspective, Look at School Year Levy Collections

The Highline District Budget Books have levy collections organized by school year, not by calendar year. For anyone interested in school year information, check the 2024-25 budget book and the 2025-26 budget book. For earlier years, the calendar and school year are very similar. For more recent years, as the spending has increased, the figures will reflect a half year at a lower amount and then the second half year at the higher amount.

Closing comment:

This is a challenging topic. As mentioned earlier, please contact the editors with any feedback or corrections..

Estimates for Years 2026-30

To estimate your taxes in future years, I think it is simplest to take your 2025 valuation, multiply it by the rate shown, then calculate the increase for each year. Here’s how this works for the example of a house with a 2025 valuation of $800,000:

2025 valuation: $800,000

Local levy rate: 1.82167 - levy amount: $1,457

2026: increase $1,457 by 21.6% - levy amount is $1,772

2027: increase $1,772 by 6.6% - levy amount is $1,889

2028: increase $1,889 by 6.6% - levy amount is $2,036

2029: increase $2,036 by 7.3% - levy amount is $2,185

2030: increase $2,185 by 7.7% - levy amount is $2,345

Highline Journal Comment Guidelines

We believe thoughtful conversation helps communities flourish. We welcome respectful, on-topic comments that engage ideas, not individuals. Personal attacks, harassment, hateful comments, directed profanity, false claims, spam, or sharing private information aren't allowed. Comments aren't edited and may be removed if they violate these guidelines.